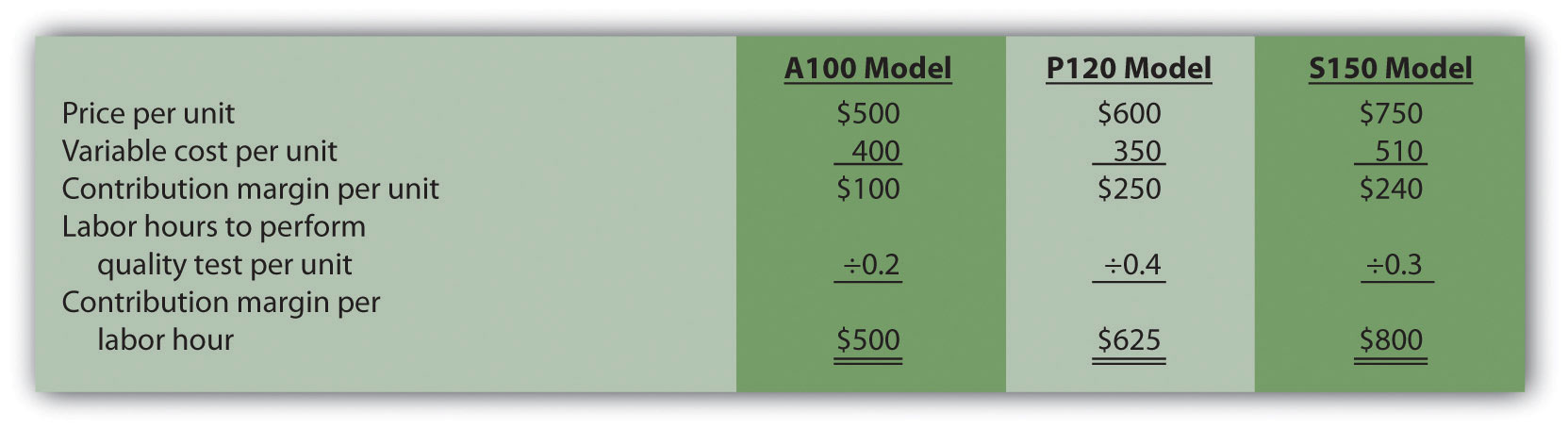

It is the incremental profit earned for each unit sold, for a single product.

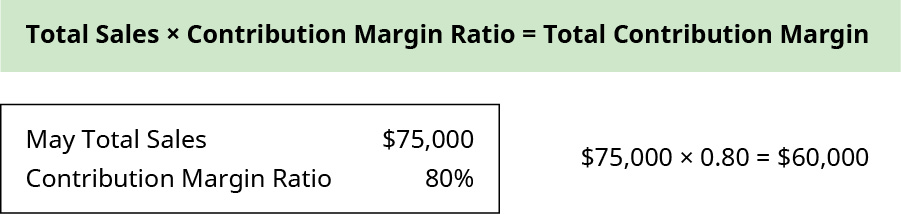

The contribution margin is a product’s price, minus all the associated variable costs. Most useful at the product level to determine profit margin, the variable cost ratio is also helpful at the organizational level because it helps determine the number of fixed costs incurred. it’s possible to use the variable cost ratio with the above formula to determine an average. You do not have to find the contribution margin of all the products individually, then obtaining the weighted average. That means in the examples above, the contribution margin ratio would be either 90% or 95%. The contribution margin is equal to 1 – the variable cost ratio. If the total variable costs of production are $1,000 per month, and the total generated revenue per month is 20,000, then the variable expense ratio in this situation is. You can also do this calculation with totals over a certain period of time. In this scenario, if a product has a per unit variable cost of $10, with a per-unit sales price of $100, there is a variable expense ratio of. With the first method, the math is done on a per-unit basis. The contribution margin is the quantitative expression of the difference between the total sales revenue and the total variable costs of production of the goods that were sold. Variable Cost Ratio = 1 – Contribution Margin The net revenue includes the sum of its returns, allowances, and discounts, subtracted from total sales. Variable Cost Ratio = Variable Costs / Net Sales It is calculated by dividing variable costs by the net revenues of an organization, as shown: The variable cost ratio is an indicator of when the variable costs associated with increasing production exceed the benefits. You cannot make 1 unit for the same price as 100 units, because you need additional materials, the lights and equipment must operate longer, and staff must be available to handle production. Variable costs, on the other hand, like purchasing raw materials, labor, and utilities increase as production increases. The fixed cost per unit declines with the production increase. Generally speaking, increasing production is more efficient for fixed costs like a building lease, because that price is fixed whether you make 1 unit or 100,000 units. Producing goods increases both variable and fixed costs. The contribution margin – fixed expenses equal net income.

In CVP analysis, the contribution income statement separates expenses into variable and fixed. It is part of cost-volume-profit analysis, otherwise known as a CVP analysis, which is an important part of many financial decisions. The variable expense ratio, sometimes called the variable cost ratio, is an accounting tool used to show an organization’s variable production costs as a percentage of net sales.

#CONTRIBUTION PER UNIT CALCULATOR HOW TO#

Variable Expense Ratio: What Is It And How To Calculate It

0 kommentar(er)

0 kommentar(er)